You’ve probably heard the saying, “You have to spend money to make money.” But maybe it should be, “You have to spend money wisely to make money.”

As your business grows, you will need to determine when and how to spend money on supplies, new equipment, new team members, and so on. You don’t want to start throwing your money around without first assessing a need, determining whether you have the money to spend, and projecting what the benefits of spending that money will be.

A cost-benefit analysis can help you determine where to efficiently spend your money for the best potential returns on your investment.

What is a cost-benefit analysis?

In 1848, a French civil engineer and economist, Jules Dupuit, wrote an article that introduced the concepts within a cost-benefit analysis. Essentially, a cost-benefit analysis involves adding up the benefits of a business decision or policy and comparing the benefits with the associated costs. Use a cost-benefit analysis to:

- Determine if an investment is sound—verify that the benefits outweigh the costs and, if so, by how much.

- Compare the total expected costs against the total expected benefits.

- Estimate the amount of time it will take to realize the benefits of your investment.

For example, say you are developing new software and your current development team is stretched to the limit. You can do a cost-benefit analysis to determine what benefits you’d gain from introducing new software to the market, how many people to hire, and how much money will be needed to pay the new hires and to estimate if the return on this investment will outweigh the costs.

How to do a cost-benefit analysis

A cost-benefit analysis, sometimes called a cost savings analysis, is critical to helping you determine whether to go forward with a new project or proposal.

Follow these six steps to help you perform a successful cost-based analysis.

Step 1: Understand the cost of maintaining the status quo

This step helps you understand the potential costs of doing nothing and can help you determine whether it is even feasible to start a new project. Sometimes doing nothing is the right thing to do. On the other hand, doing nothing can lead to disaster if you fall behind your competitors—doing nothing could end up costing you more than making an investment.

Step 2: Identify costs

Take some time to brainstorm the costs associated with the project. Make a comprehensive list that includes any cost you can think of that might have an impact, such as:

- Upfront costs

- Unexpected costs

- Tangible costs

- Intangible costs

- Ongoing or future costs

- Any potential risks that may have a cost

Consider using a mind map to brainstorm the potential costs of each project and link them back to expected benefits.

Step 3: Identify benefits

In this step, determine what the potential benefits will be if you go forward with the project. Ask yourself these questions:

- What additional revenue will come in from the investment?

- What is the return on investment? Define what the ROI means to your company—maybe you measure ROI by revenue, efficiency, or market share. However you define it, list the benefits associated with ROI.

- Determine how far into the future you should look to identify long-term benefits. If you look too far, the less confident you can be about potential benefits. For example, if you expect long-term benefits from a new computer system, rapidly changing technology could mess up your plans.

Step 4: Assign a monetary value to the costs and benefits

All costs and benefits need to be measured in the same monetary unit. If you are doing a cost-benefit analysis for a global company, don’t try to separate the costs of a project into different denominations based on country or region. It is much easier to track the actual costs and returns if you assign the same currency to everything.

When monetizing costs, be sure to include the human costs:

- How many people will be needed to complete the project?

- Will you need to hire new people?

- How much new equipment will be needed?

- Does existing equipment need to be replaced?

- Will training be involved? How much time will be lost to training?

Monetizing the benefits may not be as easy as putting a value on the costs because predicting accurate revenues can be tricky. Consult with other stakeholders to determine the value you will assign to intangible benefits, such as maintaining employee satisfaction, ensuring employees’ health and safety, or strengthening your company’s position with distributors.

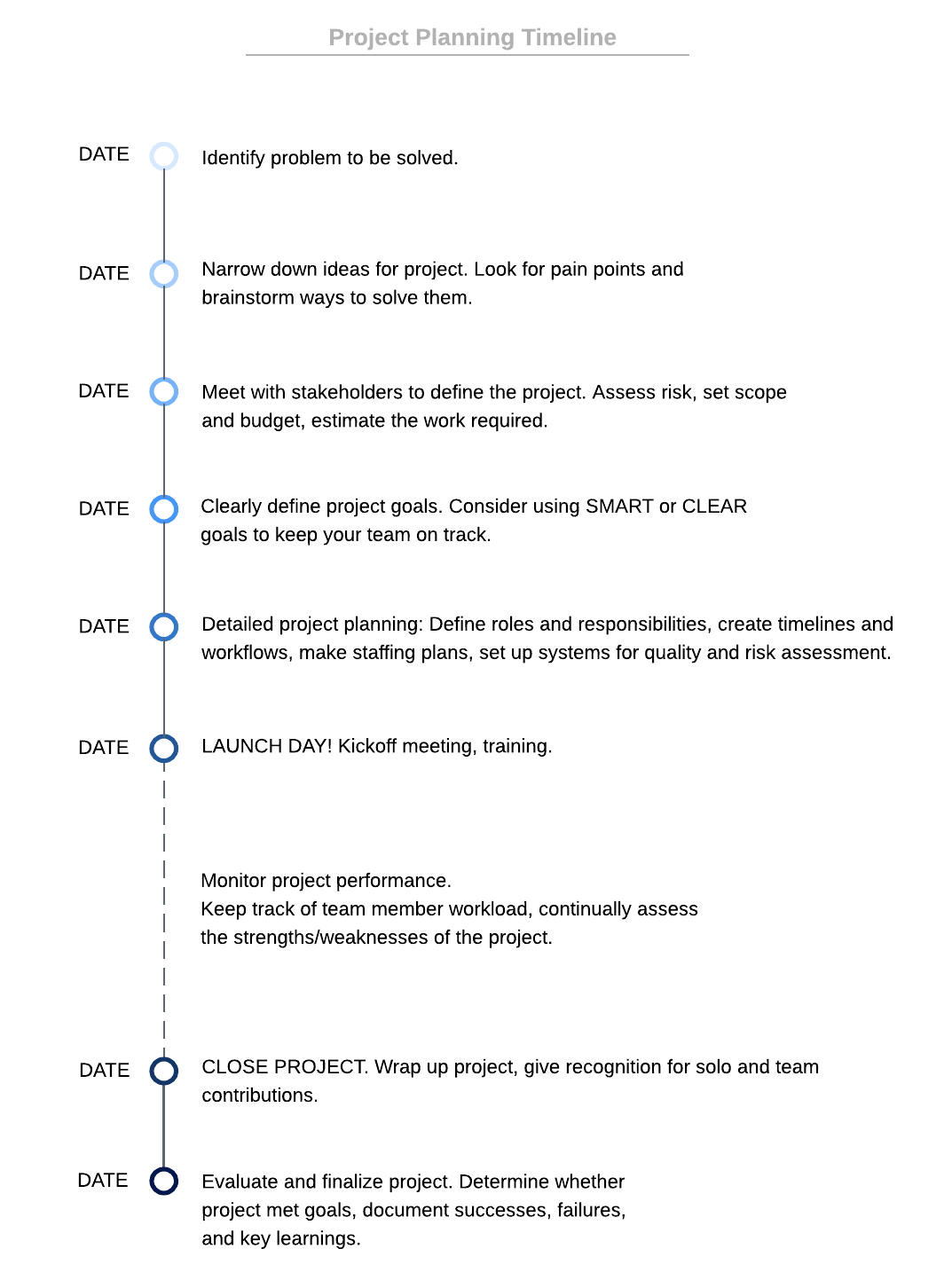

Step 5: Create a timeline for expected costs and revenue

Map out when you expect the costs and benefits to occur and how much they will be. The timeline helps you align, define, and track the expectations of all interested parties. In addition, the timeline can help you plan for upcoming costs and revenue impacts, which will let you manage and adjust as necessary as things change.

Step 6: Compare costs and benefits

Calculate your total costs and your total benefits based on the lists you’ve made. Be sure to use the same currency for all of your calculations. Comparing the two values lets you determine whether the benefits outweigh the costs.

You should also consider the following when comparing costs and benefits:

Inflation

The purchasing power of a dollar will be less in one year than it is today. For example, if the rate of inflation is three percent, in one year, one dollar will only be worth 97 cents. In 12 months, you’ll pay one dollar to buy an item that costs 97 cents today.

Lost return on investment

In spending money now to fund your project, you will lose potential income from interest if you were to invest the money instead.

Discount rate

This rate represents the future value of today’s currency considering the effects of inflation and the lost return on investment.

Payback period

The payback period defines how long it will take to reach your breakeven point when the benefits have repaid the costs. To calculate the payback time, divide the projected total cost by the projected total revenues.

Total cost ÷ revenue (benefits) = payback time

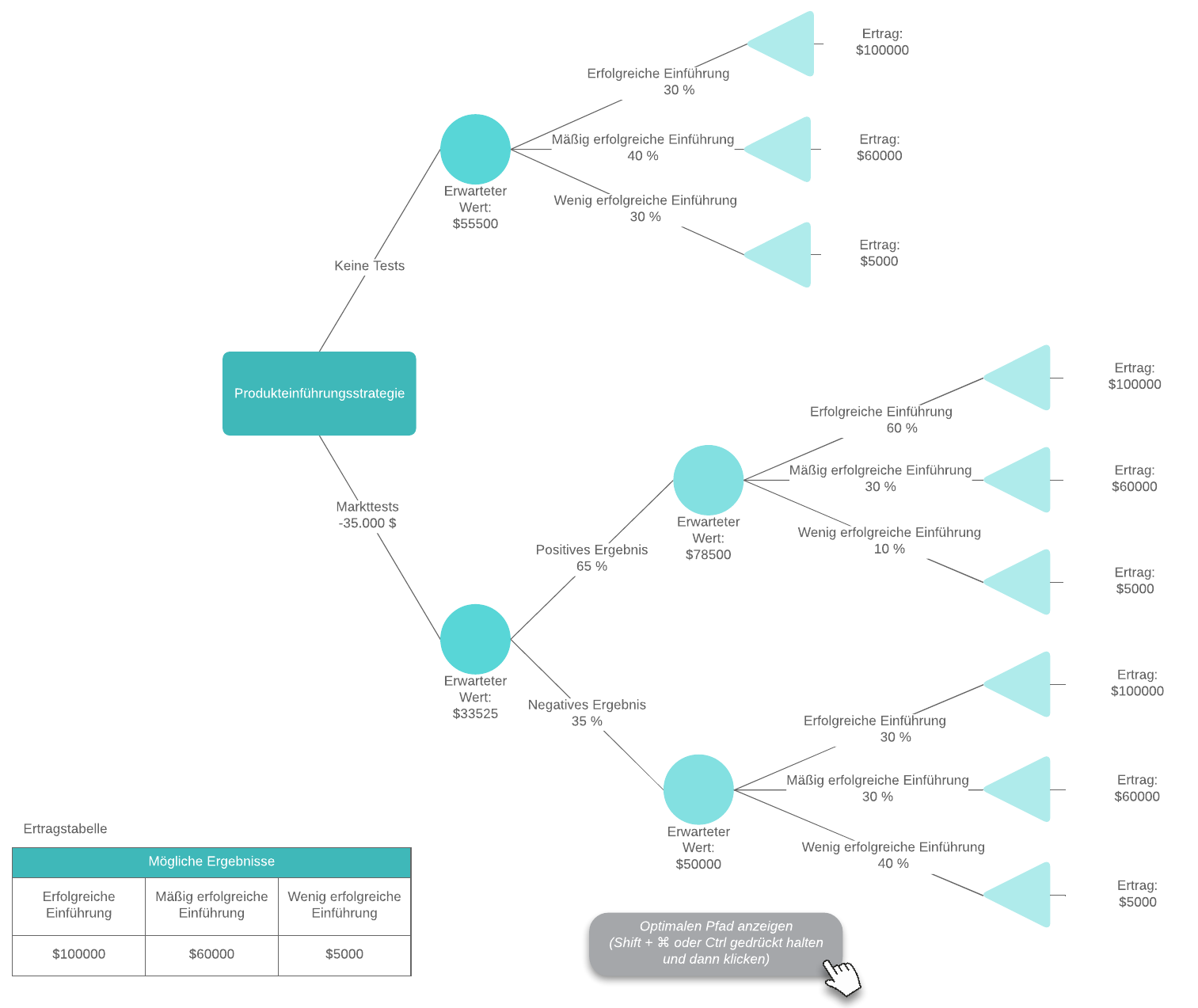

If you’re comparing the costs and benefits of different business decisions, you can create a decision tree to map out different scenarios, weigh the projected outcomes, and present your findings to stakeholders and decision-makers in a way that’s simple to understand.

How Lucidchart can help you conduct a cost-benefit analysis

Whether you are planning large or small projects, chances are that you are not conducting a cost-benefit analysis on your own. There may be many people within your organization who need or want to be involved in the analysis process. Because many companies have many geographical locations spread across the world, it can be impossible to get everybody in the same room at the same time.

Lucidchart can help you bring everybody together at the same time regardless of physical location. All documents are stored in and can be accessed from the cloud, meaning that all participants can work on the same document at the same time from any location in the world.

Because all your Lucidchart documents are stored in the cloud, they can be accessed and updated in real time as new ideas are thought of and decisions are made.

Sign up for a free Lucidchart account and get started today.

Sign up todayAbout Lucidchart

Lucidchart, a cloud-based intelligent diagramming application, is a core component of Lucid Software's Visual Collaboration Suite. This intuitive, cloud-based solution empowers teams to collaborate in real-time to build flowcharts, mockups, UML diagrams, customer journey maps, and more. Lucidchart propels teams forward to build the future faster. Lucid is proud to serve top businesses around the world, including customers such as Google, GE, and NBC Universal, and 99% of the Fortune 500. Lucid partners with industry leaders, including Google, Atlassian, and Microsoft. Since its founding, Lucid has received numerous awards for its products, business, and workplace culture. For more information, visit lucidchart.com.

Related articles

9 essential business analysis models for the BA’s toolbox

A great business analyst is armed with a toolbox of visual modeling techniques to help them drive successful project outcomes. In this article, you'll find nine of the best techniques, including process flows and SWOT analysis diagrams.

What is gap analysis? 4 steps and examples to use

A strong gap analysis process allows professionals to determine where their businesses are—and where they want it to be. To perform a gap analysis, follow these four simple steps.