How to plan and execute successful mergers and acquisitions

Lucid Content

Reading time: about 12 min

Topics:

A merger is defined as two or more companies mutually agreeing to come together to form a new company.

An acquisition occurs when one company takes over another company. The purchasing company buys a controlling interest or the entire business operation, including assets. The purchased company is absorbed by the purchasing company and a new company is not formed.

There are many reasons why mergers and acquisitions occur, all of which ultimately boil down to economic reasons—you want to make more money while spending less. Common reasons for mergers and acquisitions include:

- Decrease the competition.

- Increase operational capacity and efficiency.

- Grow market share.

- Increase revenue and decrease costs.

- Diversify products or services.

- Acquire unique, patented technology that fits well with the acquiring company.

- Combine similar companies, products, technologies, and efforts.

Let's discuss the lifecycle of mergers and acquisitions and outline the steps you need to take in order to be successful.

Mergers and acquisitions life cycle

The mergers and acquisitions (M&A) life cycle is broken down into three categories: Strategy, Execution, and Integration.

Strategy

Strategic planning helps protect you from M&A failures. Just because you want to buy a company doesn’t mean you should buy that company. There are several questions you should ask yourself when researching target companies.

- Why do you want to acquire, or merge with, another company?

- What is your business objective?

- Do the target company’s products or services fit with your objectives?

- What value will the deal bring you?

- What is the value of the target company?

- Does the company culture fit with your company?

These types of questions can help you narrow your choices as you screen the companies you are interested in, determine target company valuations, structure deals, and analyze how your business decisions will give you an advantage in the current market.

Importance of synergy

Synergy is a combined action or operation. Many companies decide to merge with or acquire another business based on potential synergies that can come from combining similar products and technologies. The following are some benefits that synergy can bring when companies merge:

- Combine workforces—Identify and eliminate redundancies and restructure workflows to increase efficiency and to accommodate increased business volume.

- Combine technologies—Combining similar technologies can help a company to achieve strategic advantages in your market.

- Reduce costs—Consolidation can improve your purchasing power and decrease costs as you negotiate better terms with vendors based on the need for more materials because of increased output.

- Market expansion—There is potential that combining companies will create an advantage in a particular market, or enter into a market that was not previously available to you.

Execution

During this phase, you’ll want to gather experts and people with M&A experience. You need people who are expert advisors in HR, IT, operations, legal, taxes, and finances to help you cover all your bases and to help the transition run smoothly.

All of this experience, expertise, and knowledge come together to ensure that closing the deal will continue to meet the goals and objectives you established during the strategy stage.

Integration

Integration brings another set of challenges because now two companies with two cultures need to figure out how best to work together.

You will need to put together an integration team to help the integration run smoothly. Members of this team should include:

- Senior executives to keep stakeholders informed about merger progress, to communicate the value of the merger, and to ease concerns about the company’s future.

- Due diligence team to retain important information. The due diligence team works with the integration team to ensure that all data is successfully transferred, that there are no redundancies, and that no information is lost.

- Human resources to communicate with and answer questions from employees about job positions, benefits, roles, and expectations going forward.

- Change management experts to help the purchased company feel cared for, to drive employee morale, and to help employees and stakeholders buy in to the idea of being acquired. Change management experts can help to avoid problems.

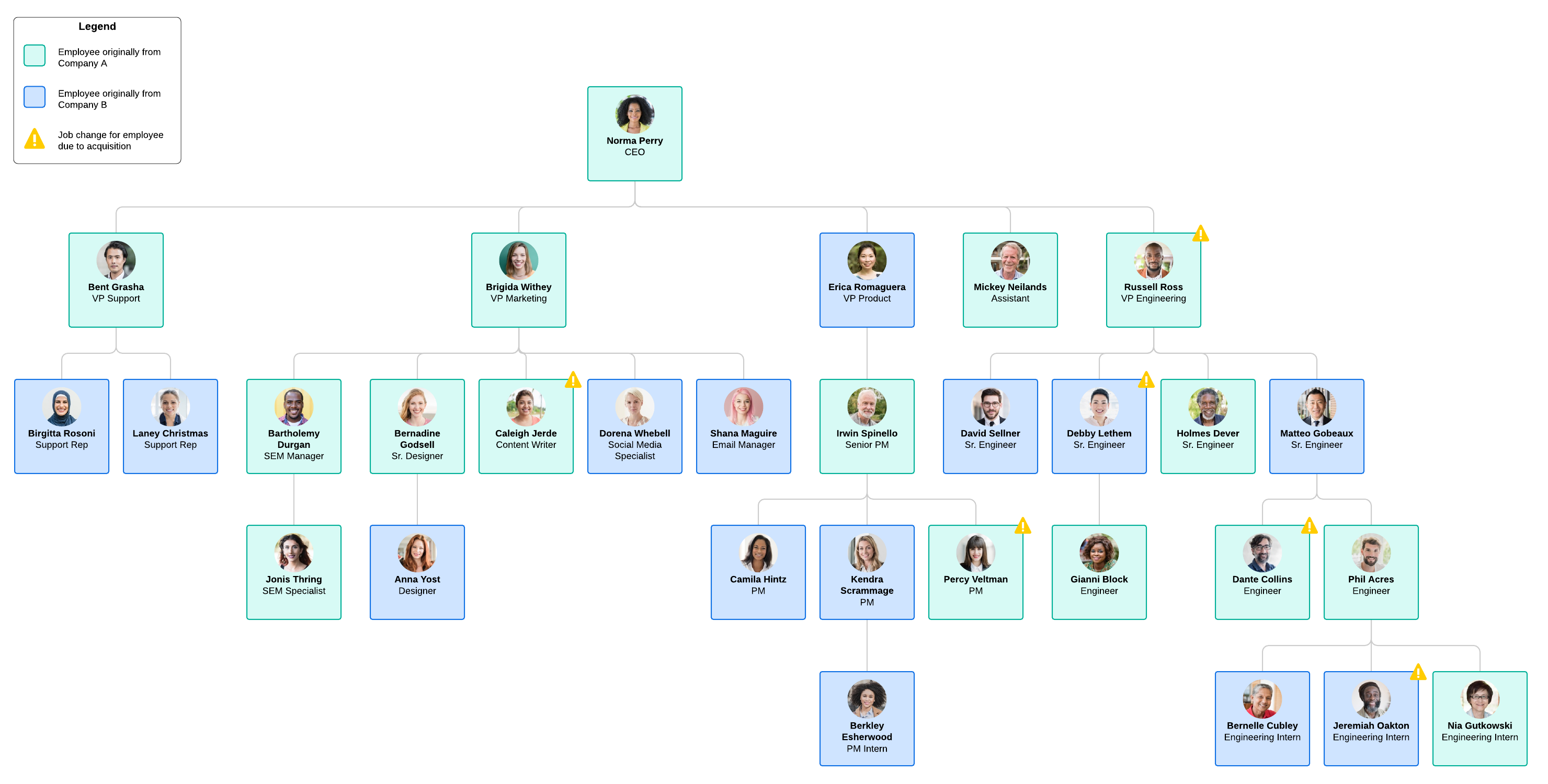

Consider using existing org charts and drawing new charts as needed during the integration phase. Org charts can give you valuable information like where people are physically located, what teams they are assigned to, their specific roles and responsibilities, and who reports to whom. This information can give you insight as you plan for restructuring organizations, departments, and business units. It can also help you understand the human capital of the organization that was just purchased.

Steps for the buyer in the M&A process

Following a step-by-step process is essential for successfully navigating your way through the complexities of M&A. Below we briefly discuss 10 steps that the purchasing companies typically use during the M&A process.

Step 1: Develop an acquisition strategy

This step falls within the strategy phase of the M&A lifecycle. It is essential that you know why you want to acquire a company and what you expect to gain from the merger.

Step 2: Set the M&A search criteria

Determine the criteria for searching for potential targets, such as location, industry, profit margins, customer base, and so on.

Step 3: Search for potential acquisition targets

Use the search criteria you identified to look for and evaluate companies that may fit with the goals you want to achieve from acquiring the other company.

Step 4: Begin acquisition planning

Contact the companies that were found in your searches. Get more information to begin evaluating the potential value of a deal and to see how open the company is to M&A.

Step 5: Perform valuation analysis

When you find a company that is interested, ask for financial, market, and other information that will help you to begin determining the company’s value as a standalone company and a potential acquisition target.

Step 6: Begin negotiations

Create some valuation models to give you enough information to make a reasonable offer. After the offer is made, negotiate terms and iron out details.

Step 7: Perform M&A due diligence

When the offer is accepted, your due diligence team starts an exhaustive process that works to confirm or correct the purchasing company’s assessment of the target company’s value. The team performs a detailed examination and analysis of the target company’s entire operations including finances, assets, liabilities, customers, employees, and so on.

Step 8: Draft a purchase and sale contract

If due diligence does not unearth any major problems or concerns, write up a final contract for the purchase by the acquirer and the sale by the target company. The contract defines the type of purchase agreement—asset purchase or share purchase.

Step 9: Develop a financing strategy for the acquisition

Financial options have most likely already been explored, but at this step you need to work out the details after the purchase and sale contract is signed.

Step 10: Close the deal and begin acquisition integration

After the deal is closed, the management teams from both companies work together to integrate the two businesses into one as seamlessly as possible. Members of the HR team and change management experts work to make employees feel like they are all part of the same team. Use org charts to get a quick overview of company hierarchy to help with restructuring and reorganization.

Best M&A practices for the buyer

Because M&A is a complex process, you will need to pay attention to detail, remain focused, and be willing to compromise. Below are a few best practices to consider when you are on the buying side of the M&A.

-

Be diplomatic and sensitive with your offer—Don’t make this a hostile takeover. You should have done your homework and should have found the company that best fits your criteria. Your offer needs to be beneficial to you as well as to the company that is being purchased.

-

Put together a team of experienced leaders and advisors—Experience and strong leadership can help put all interested parties more at ease with the process. If your team doesn’t act like they know what they are doing, it will be harder to get buy-in from employees.

-

Culture fit should be top of mind—Keep in mind that there could be some pushback from the company being acquired if the company cultures clash.

-

Be trustworthy—Be honest throughout the M&A process. The acquisition will fail if employees from the purchased company feel that the buyer is dishonest and untrustworthy.

-

Communicate and be transparent—M&A is a stressful time for employees. Keep the lines of communication open to help alleviate fears and anxieties that could negatively impact productivity. Answer questions honestly and promptly.

-

Develop a transition plan—Before the deal is closed and even before due diligence is completed, work on a transition plan. Work with HR and use org charts to evaluate employees to find the best fit for leadership positions and team assignments.

Steps for the seller in the M&A process

It’s possible that a purchasing company might have more experience in the M&A process than the selling company. However, the seller also plays a key role in the process and should not just sit back and let the buyer call all the shots. The following are a few steps for the seller to take to help with mergers and acquisitions.

Step 1: Define the strategy

Just like the buyer needs to know why they are looking to acquire a company, the seller should have a clear idea of why they want to sell. Know what the rationale is and what objectives you want to achieve from the sale. Identify the buyers, or the qualities you want in potential buyers, that would contribute to an ideal selling situation.

Step 2: Compile information

Put together a comprehensive informational kit to formally present your company’s products and services, technology, financial standing, and market positions to buyers.

Step 3: Contact buyers

Whether a buyer reaches out to you or you reach out to potential buyers, be strategic and only talk to companies that will be a good fit. Contact more than one buyer, but don’t waste time with buyers who are unlikely to acquire your business.

Step 4: Take bids

Ideally, after companies have talked to you and evaluated the informational materials you have put together, the offers will start coming in. You never want to take the first offer. Weigh all the offers to see which is the most beneficial for you and for the buyer.

Step 5: Meet and negotiate with interested bidders

Meet with the companies that are interested in purchasing your company to find out more about their intentions, what their needs are, and what they are proposing and offering. After you have looked at bids from the interested parties, start the negotiations. Refer to your defined strategy to help you narrow down to the best candidates. Remember that until the company is sold, it is still your company. Any promises made by either side are moot until negotiations are completed and the final agreement is signed.

Step 6: Draft an agreement

The buyer and the seller work together to draft a mutually beneficial deal. Once you enter into an exclusivity agreement, it means that you are locked into an agreement with the company that wants to acquire your company. At that point you can’t seek out other buyers or enter into negotiations with other entities.

Step 7: Facilitate buyer’s due diligence

The buyer will have to complete due diligence before the sale can be completed. It can take up to two months to complete due diligence. Help speed up the process by gathering all documentation ahead of time and stay in close contact with your buyer to help solve any problems and issues that may come up.

Step 8: Get final board agreement

When the due diligence process is completed and the buyer wants to go forward with the purchase, get final agreement from the board.

Step 9: Sign the agreement

When both companies have signed the final agreement, the company has been sold and has merged with or been acquired by the buyer.

Best M&A practices for the seller

Mergers and acquisitions can be a long and emotionally draining process. You will need to remain focused to ensure that you are getting the best deal. The following are a few tips and best practices you may want to consider during the process.

-

Don’t take the first offer—Unless it is your only offer, the first offer may not be the best offer. Even if it is the only offer, you are free to negotiate if you feel like the offer undervalues your business and technologies.

-

Bring more than one buyer to the table—This gives you a better opportunity to determine which company is a better fit. While the sale is about money, it’s not all about the money. You need to sell to the company that most closely aligns with your company’s values, culture, work ethic, and so on.

-

Form a team of experienced leaders and advisors—Working with, and listening to, people who have experience in these types of business dealings can help you to make informed decisions. Don’t rely on analysis alone. Talk to experienced buyers and sellers and be open to the advice they give you.

-

Don’t ask too much or too little for the business—A really high or unrealistic price tag can stop negotiations before they begin. On the other hand, setting a price that is too low gives the impression that you don’t understand the worth of your business. Make sure you know what the company—including its technology, assets, and human resources—is worth.

The M&A process doesn’t happen overnight or even in a couple of weeks. It is a long, complex, and detailed process that requires patience, diplomacy, compassion, and compromise. The steps and best practices we’ve outlined can help you to remain focused, pay attention to detail, and get the deal done right.

How can you better prepare employees for an M&A? See our list of guidelines.

Read nowAbout Lucidchart

Lucidchart, a cloud-based intelligent diagramming application, is a core component of Lucid Software's Visual Collaboration Suite. This intuitive, cloud-based solution empowers teams to collaborate in real-time to build flowcharts, mockups, UML diagrams, customer journey maps, and more. Lucidchart propels teams forward to build the future faster. Lucid is proud to serve top businesses around the world, including customers such as Google, GE, and NBC Universal, and 99% of the Fortune 500. Lucid partners with industry leaders, including Google, Atlassian, and Microsoft. Since its founding, Lucid has received numerous awards for its products, business, and workplace culture. For more information, visit lucidchart.com.