Best practices for the accounts receivable process

Reading time: about 4 min

Topics:

If you have ever let a friend buy your dinner, promising them you’ll pay them back later, you understand the basic principle of accounts receivable. Accounts receivable refers to outstanding invoices or the money that customers or clients owe the company for any goods or services rendered. It’s essentially a corporate IOU.

When a company sells an item or service, they can either request payment at the time of purchase or extend credit to the buyer so they can pay the total cost later.

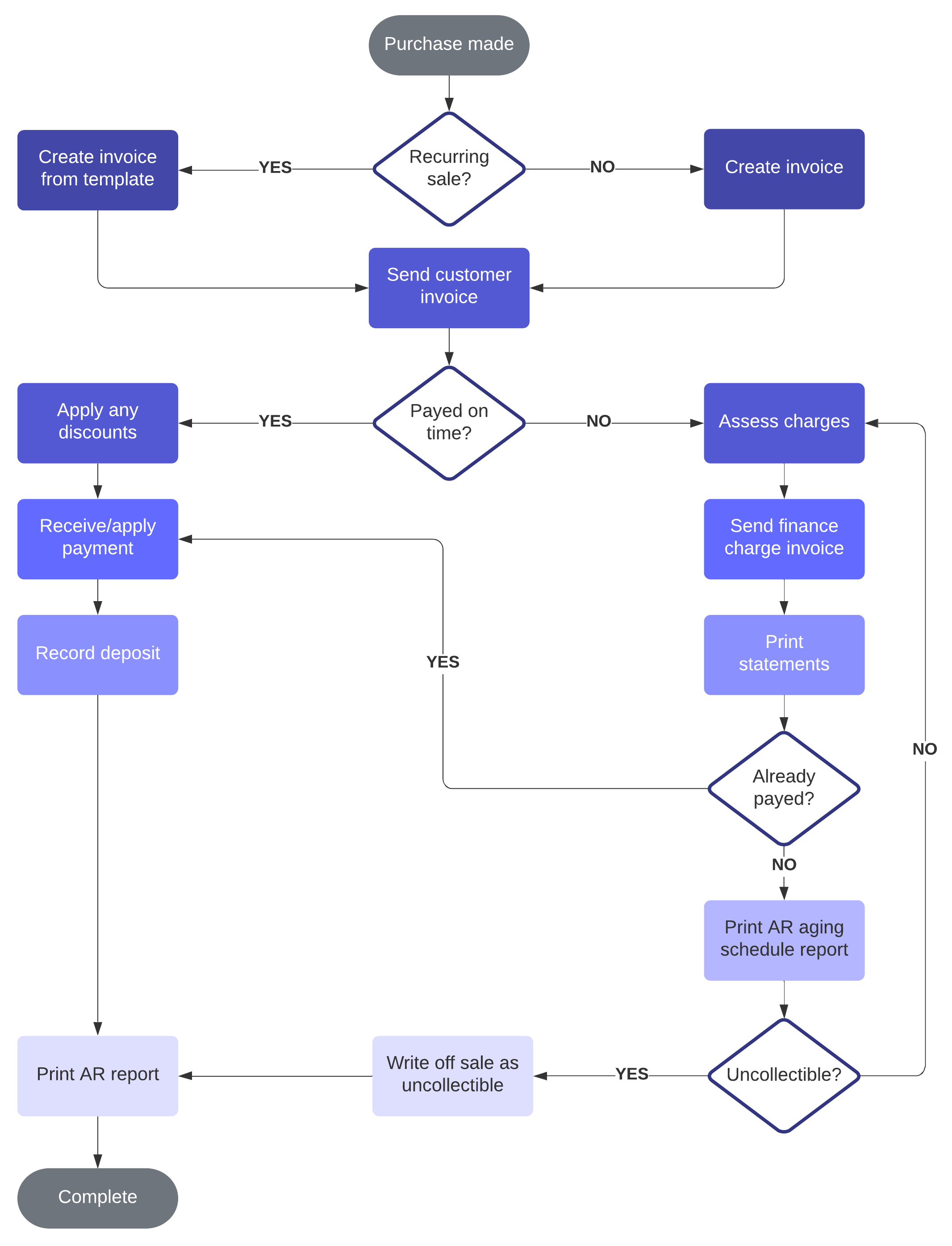

If a customer pays immediately, the transaction is recorded and reported. Case closed. But what if someone pays with credit? With an accounts receivable process flow in place, you can ensure that your company still receives payment. Use the following accounts receivable best practices to build a successful AR process flow.

Best practices for implementing an accounts receivables process

Some of the most basic and essential steps for a typical AR process flow are the following:

- Develop a collection plan.

- Document your collection process.

- Log all charges and expenses concurrently.

- Incentivize early payments by offering discounts.

- Build and maintain relationships with clients.

- Have a plan in place to always get your payments.

1. Develop a collection plan

Create invoices to bill clients at the right time. Ask your clients what day is the most convenient for them in terms of cash flow. Some customers might get billed bimonthly, some weekly. It will depend on your business agreement.

Consider these factors when creating a new business agreement:

- What is this customer’s payment history? If they’ve always been on time, then you can be lenient when they need an extension. If they’re routinely late, then you may need to build a more detailed payment plan.

- How does your business stand? If you need to get money back faster, then you’ll have to make your payment terms shorter.

- What are the industry standards? Take a look at the billing practices in your field. Depending on what you’re able to afford, decide whether you’ll match payment terms or outdo your competitors by giving your customers an advantage (e.g., more time).

Agree on a date and send all invoices electronically to keep better documentation. This strategy will streamline your accounts receivable process flow.

Learn how Lucidchart can help you refine and document your accounting cycle.

Read now2. Document your collection process

So now you’ve got a plan, but how can you make sure that everyone follows it? Or that it’s working the way it should? You need to document your AR collections process. Visualizing your accounts receivable process steps in Lucidchart can help you:

- Reduce errors in billing.

- See which processes could be automated or done electronically to reduce input errors.

- Audit and optimize your process.

- Onboard new employees more quickly.

Learn how to streamline your accounts payable process in Lucidchart.

Read more3. Log all charges and expenses concurrently

Another best practice is to scan all receipts, orders, and requests as they arrive so that they’ll always be in the system for the next invoice. If you delegate invoicing responsibilities to specific staff, they’ll anticipate the tasks needed for completion.

4. Incentivize early payments by offering discounts

One of the most trying aspects of AR collections is securing timely, consistent payments. However, every business loves a good deal. Not every company will have a strong enough cash flow to take the offer, but you can incentivize the companies that do to make payments earlier by offering them some kind of discount.

5. Build and maintain relationships with clients

The best-kept secret for successful accounts receivable collection? Make your clients feel like gold. If you’ve ever had an overdue medical bill or credit card debt, chances are you’ve received a host of annoying calls. No one enjoys those—you don’t know who the voice on the other end is and you’re not exactly ecstatic to pay.

However, to ante-up the accounts receivable process, you need to make sure your AR staff have phenomenal relationships with clients and maintain consistent contact with them. Always respect the client and make sure your business focuses on the clients and how they will feel at each stage of the process.

6. Have a plan in place to always get your payments

In spite of how great your client relationships are, unforeseen circumstances sometimes prevent payment—not meeting revenue, interrupted cash flow, and even bankruptcy.

Regardless of the cause, don’t let it affect your accounts receivable process. If you happen to stumble upon a worst-case scenario non-payment issue, here are six steps to follow:

- Make a friendly phone call asking if they need more time.

- Wait no more than five business days before calling again.

- Visit them in person, and then send a follow-up email explaining your concerns.

- Send a letter of demand.

- Send a final letter of demand, if needed.

- Hand the case over to a debt collection agency.

Sometimes even the best clients have cash flow problems. However, setting up all payment expectations at the beginning of the relationship will better every outcome.

These basic tips should help you streamline your accounts receivable process. Planning ahead and sticking to your plan by documenting your process allows your employees to be more efficient and consistent when handling collections. Overall, this will make it possible for the rest of your business to operate smoothly and invest in growth.

Remove inefficiencies and optimize your business processes with Lucidchart.

Learn howAbout Lucidchart

Lucidchart, a cloud-based intelligent diagramming application, is a core component of Lucid Software's Visual Collaboration Suite. This intuitive, cloud-based solution empowers teams to collaborate in real-time to build flowcharts, mockups, UML diagrams, customer journey maps, and more. Lucidchart propels teams forward to build the future faster. Lucid is proud to serve top businesses around the world, including customers such as Google, GE, and NBC Universal, and 99% of the Fortune 500. Lucid partners with industry leaders, including Google, Atlassian, and Microsoft. Since its founding, Lucid has received numerous awards for its products, business, and workplace culture. For more information, visit lucidchart.com.

Related articles

Streamlining the accounts payable process

Keep on track and maybe save your company some money by developing and documenting a seamless accounts payable workflow chart with Lucidchart.

Refine your accounting cycle steps with Lucidchart

Learn the accounting cycle steps and how Lucidchart can help streamline the accounting cycle at your organization.

The ins and outs of effective business processes

An in-depth guide to rethinking business processes with simple, yet powerful, techniques you can use to begin improving your own processes.

Why you must continuously evaluate and improve business processes

As businesses scale and try to innovate to keep up with the competition, the need to evaluate current practices and improve processes becomes inevitable. Learn more about why process improvement is essential.